Refund

Where's my refund?

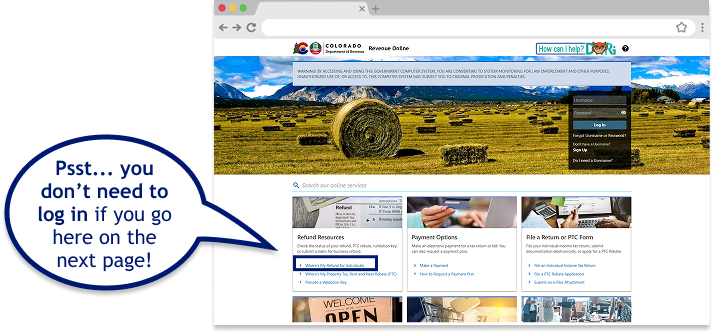

Track your refund status instantly with Revenue Online (ROL). This shows the same information our staff sees when looking at your refund status, so you do not need to call. The information is updated regularly, so you can check it for updates daily.

Check My Refund Status on ROL

Take the Where's My Refund? Survey

When will I get my refund?

Each tax return is unique so the amount of time before you receive your refund will vary. On average, expect the following timeframes before receiving your refund:

- e-filing: 3-5 weeks

- paper filing: up to 3 months

This video provides an estimated timeline for receiving your individual income tax refund while emphasizing the importance of accurate filing for quick processing. It offers a guide on how and when to check your refund status using Revenue Online. The video also addresses common issues, such as direct deposit concerns, security-related conversions of direct deposits to mailed checks, and when to start the refund check reissue process.

Need Help?

Refund Status

- I haven’t received my direct deposit. What should I do?

If you requested Direct Deposit on your Colorado state income tax return and did not receive it, you should first contact the bank or financial institution to determine if they received your refund credit. Electronic transactions are posted daily, and may not be reflected on your latest

bank statement. If your financial institution has no record of your refund, you can check the status of your refund by visiting our Revenue Online service.

You can also read more on our Direct Deposit Refunds webpage.- How do I ensure that my refund is processed quickly?

Read filing instructions carefully and ensure a return is complete and correct to the extent possible. This includes filling out all forms completely, double-checking calculations, attaching all relevant documentation and ensuring sensitive information such as Social Security numbers and bank routing and account number is thorough and accurate. Double-check a return before submitting to determine all information is included and accurate. Pay particular attention to the following fields:

- Name

- Address

- Phone Number

- Date of Birth

- Social Security Number or ITIN

- Driver License or ID Number (if requested)

- Employer ID Number on W-2 document(s)

- Bank Account Information (Routing Number/Account Number)

- I can't check the status with the refund status tool. What do I do?

Please verify the refund amount you have entered and verify that you are using the primary SSN for the return/refund. You may want to try using a Letter ID instead of the refund amount.

- You have not updated the status of my refund in a while. When will I receive it?

Each return processes through multiple steps. We recommend you file electronically and include all documentation to ensure we can process your return/refund as quickly as possible. Please check back on the status daily. If we require additional information, we will contact you

through U.S. Postal Service mail.

Irregular Reasons for Delay

- What could delay my refund?

There are a few situations that can slow down your refund:

- Filing with a paper return

- Electing to receive refund via paper check

- Errors on your return (you will receive a letter if this occurs)

- Some returns are identified for additional review (you will receive a letter if this occurs)

- I received a "Validation Key" letter. Will that delay my refund?

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a "Validation Key" process where information will be requested to be entered on Revenue Online

to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification webpage for more information.- I received a Notice of Deficiency or Rejection of Refund Claim. What can I do?

If you received a Notice of Deficiency or Rejection of Refund Claim from the Colorado Department of Revenue, there are a few ways you can respond. Learn more about your protest rights and the process on Step-by-Step Guide For Responding to Rejection of Refund Claim

webpage.- Why was my tax refund intercepted?

Visit the Intercepted Refunds webpage to learn about why your refund may have been intercepted.

- Why was my direct deposit converted to a paper check?

Some refunds that are requested as Direct Deposit may be converted to paper check and mailed to the taxpayer's address as a method of verifying that the refund is legitimate. A letter will come with the refund that was converted to a paper check. The letter contains a phone

number taxpayers can call. Please visit the Direct Deposit webpage for more information.

Paper Checks

- My check was mailed. Where is it?

After your tax return has been received and processed, please note that it usually takes about 7-10 business days for the U.S. Postal Service to deliver the refund checks, but occasionally it can take up to 45 days. If your refund check has not been received after 45 days from the

issued date, or has been destroyed, lost or stolen, please call 303-238-7378 and request to have a refund reissue form mailed to you.- Can I change the address for my paper refund check?

The U.S. Postal Service will forward paper check tax refunds when a forwarding mailing address has been submitted. However, if you did not submit a forwarding address with USPS, a paper check must be reissued with your correct address. You must call our Tax Information

Call Center at 303-238-7378 to start the process.- My refund check might be lost, missing or destroyed. What do I do?

After your tax return has been received and processed, please note that it usually takes about 7-10 business days for the U.S. Postal Service to deliver the refund checks, but occasionally it can take up to 45 days. If it has been more than 45 days and you have not received your refund check, you can start the refund check reissue process. Please read below for more information.

- Lost: You can request that the original refund be voided and a new refund be issued. Follow the Reissue Process below.

- Missing: Did you use the correct mailing address when you filed the return? Check the status of your refund and your address by visiting Revenue Online.

- Damaged/Destroyed: You can request that the original refund be voided and a new refund be issued. Follow the Reissue Process below.

You can start the refund check reissue process by signing a refund reissue letter. Request the letter through 303-238-SERV (7378).

- Lost: You can request that the original refund be voided and a new refund be issued. Follow the Reissue Process below.