Filing Requirement Changes for Partnerships and S Corporations

DISCLAIMER: You have the option to amend returns from 2018-2021 from September 1, 2023 through June 30, 2024. Please check the SALT Parity Act Election webpage for more information.

For tax years 2022 and later, every partnership and S corporation is required to complete a Colorado K-1 (DR 0106K) for each of its partners or shareholders for each tax year.

Submission of Colorado K-1s by Partnerships and S Corporations

Partnerships and S Corporations must file the completed Colorado K-1s with the Department, as described below. On or before the date the Colorado K-1s are filed with the Department, the Partnership or S Corporation must furnish each partner or shareholder with a copy of the Colorado K-1 reporting their income, deductions, modifications, and credits.

Individual Partner and Shareholder Instructions For 2022 Colorado K-1 (DR 0106K)

Due Dates

Colorado K-1s are due to be filed the fifteenth day of the fourth month after the close of the tax year, or after the automatic six-month extension, if applicable. Colorado K-1s for calendar year filers are due on April 15 every year. If the due date falls on a weekend or federal holiday, the Colorado K-1s will be due the next business day.

Before filing the DR 0106K please review all of the form instructions included with the form. The DR 1706 is not needed if you are filing the DR 0106Ks electronically as outlined below.

Methods to Filing Colorado K-1s with the Department

Partnerships and S corporations must submit a copy of each partner's or shareholder's Colorado K-1 to the Department through one of the following methods:

- Colorado K-1s may be included with the partnership or S corporation’s Colorado return filed through Modernized e-File (MeF).

- Spreadsheet (XLS) uploaded electronically through Revenue Online.

- XML uploaded electronically through Revenue Online.

- Manually input data electronically through Revenue Online.

- Paper form DR 1706 by mail.

Tip: You may submit multiple partnership and S corporation records in a single XLS or XML file. If you upload one and then try to upload a second, the data from the first file will be deleted.

Note: Do not submit the copies of the Colorado K-1s issued to partners or shareholders (or the DR 1706 transmittal form) as an attachment to a paper income tax return (form DR 0106, or as a PDF attachment to an MeF income tax return), filed for the partnership or S corporation.

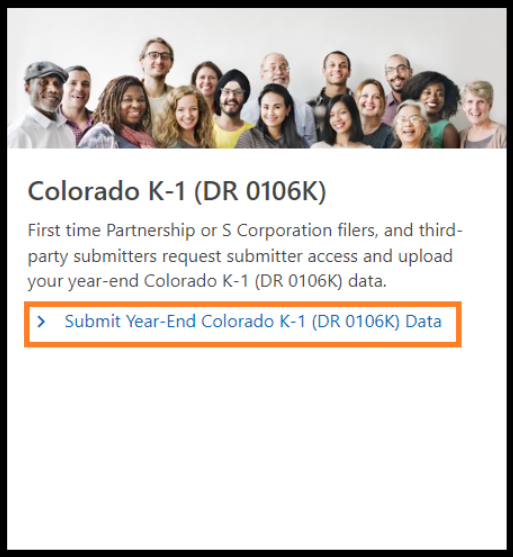

Electronic filing is completed through the Colorado K-1 submitter located on Revenue Online without signing in. Scroll down to the tile titled "Colorado K-1 (DR 0106)" as illustrated in the steps below.

E-File Methods through Revenue Online

- Upload Spreadsheet (XLS), see step 4a below.

- Upload XML, see step 4b below.

- Manual entry of each partner's DR 0106K form, see step 4c below.

Note: Web submitter access for Colorado K-1 (DR 0106K) is required for E-File Method.

*If you have an active Partnership or S-Corporation account with the Colorado Department of Revenue, we registered the web submitter access for your convenience. Please follow the steps below if you do not have access.

**Please request web submitter access if you are a first-time Partnership, S Corporation filer, or Third-Party submitter from the Revenue Online homepage. Once your request is processed, you can submit the form electronically by logging into your Revenue Online account or from the Revenue Online homepage.

For questions regarding the submissions process, please contact the Discovery Section at 303-205-5252.

Before you start using Revenue Online for Colorado K-1 (DR 0106K), you must register to be a web submitter for Colorado K-1 (DR 0106K). You cannot submit documents until the registration process is complete.

Step 1:

Look for the "Submit Year-End Colorado K-1 *DR 0106K) Data" menu panel on the Revenue Online homepage. No login is required.

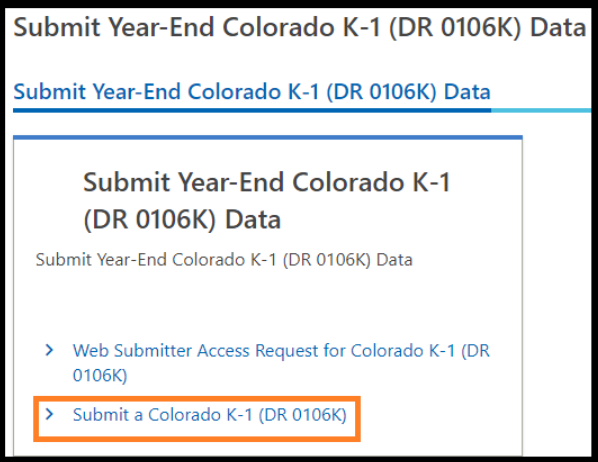

Step 2:

Select the "Submit a Colorado K-1 (DR 0106K)" link.

Note: Read the purpose, eligibility and information needed to continue. Click "Next".

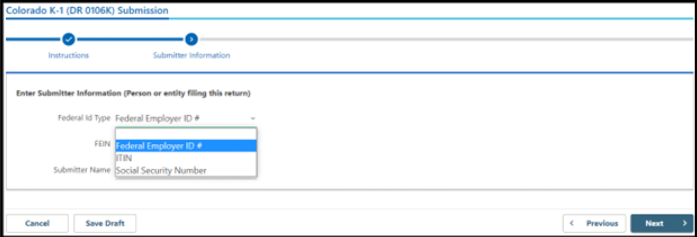

Step 3:

Enter Submitter Information. Click "Next".

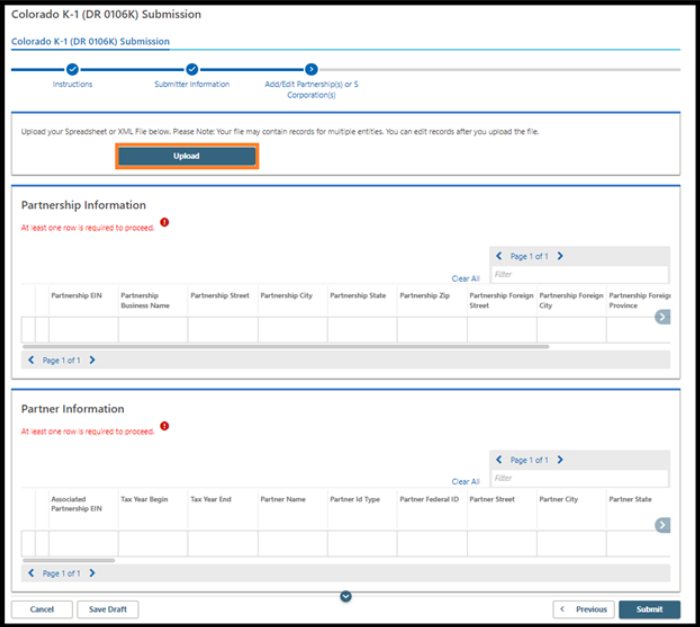

Step 4a:

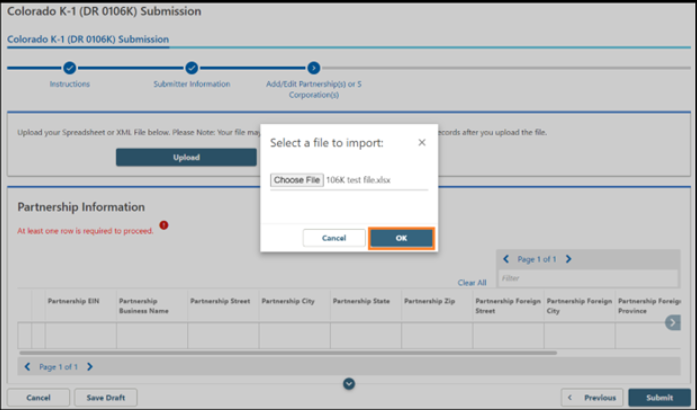

Upload Spreadsheet (XLS). Click "Upload".

Click "Choose File"

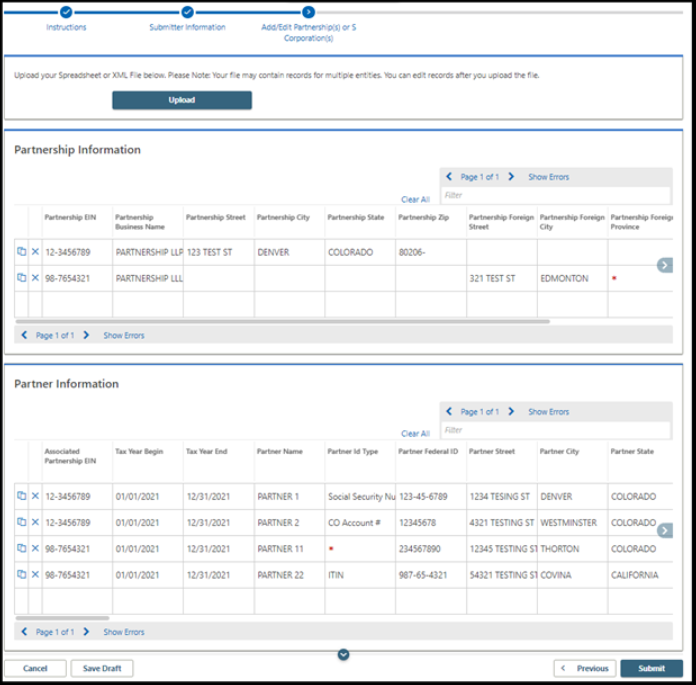

Below is a screenshot of when you choose to upload the spreadsheet file.

Templates: Spreadsheet template (XLS)

Sample files: Spreadsheet Sample (XLS)

Step 4b:

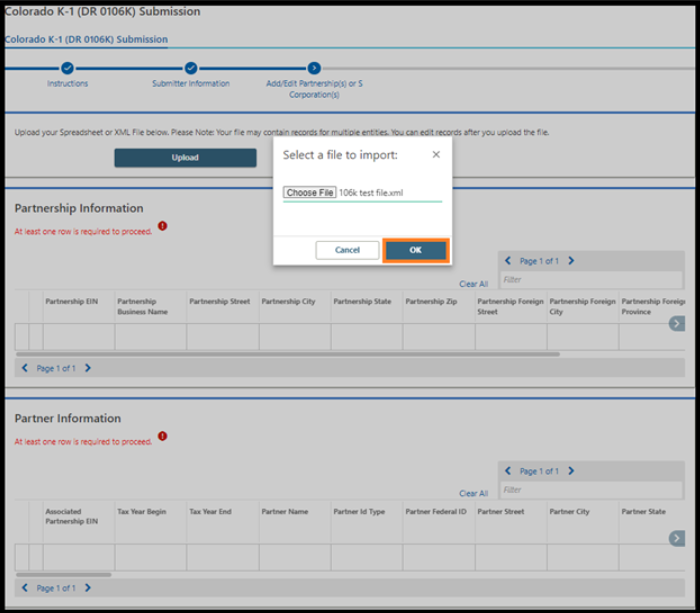

Upload XML File. Click "Upload".

Click "Choose File".

Below is a screenshot of when you choose to upload the XML file.

Templates: XML Schema

Sample Files: XML Sample

Additional Files: XML File Layout Addition Resources

Step 4c:

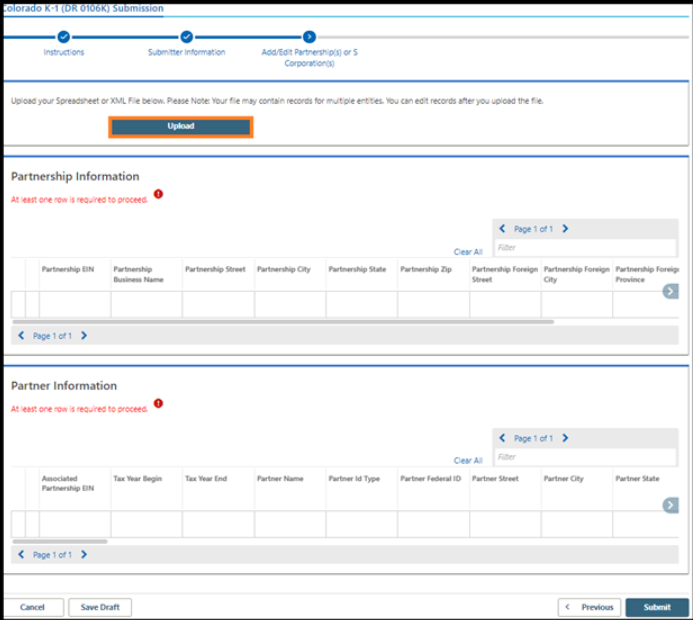

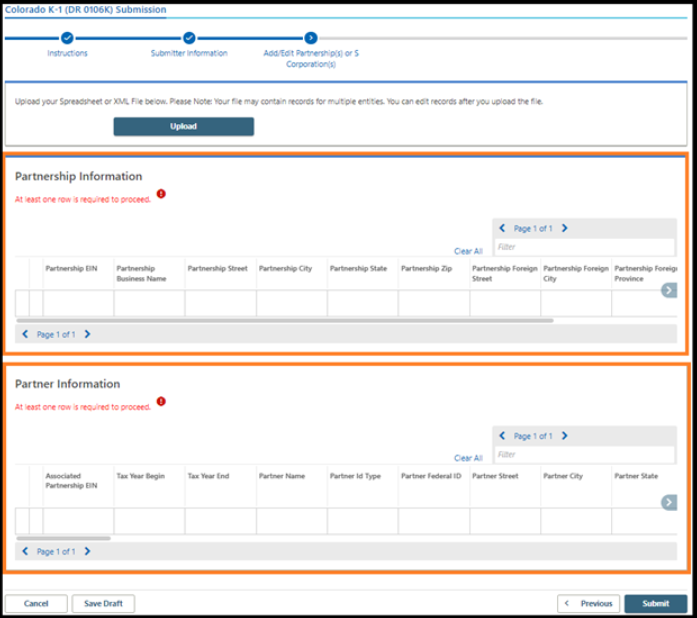

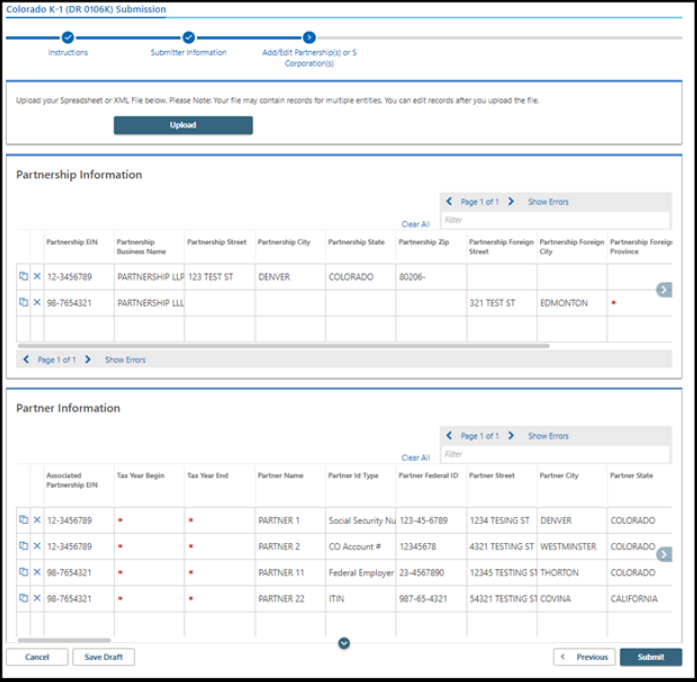

Manually enter records of partnership information and partner information. Do not click "upload".

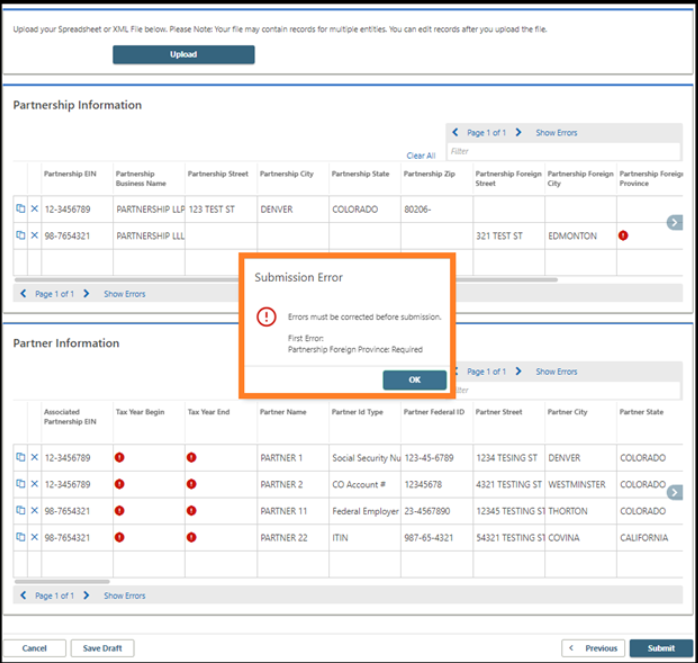

Select "OK". After you upload a spreadsheet (XLS) or XML file, you may see the following screenshot with errors.

Note: You can add/edit your partnership and partner information. An asterisk (*) is used to call your attention to edit it because it indicated an omission. An exclamation mark (!) is used to inform you that required information has not been added. You may save your work by clicking on "Save Draft" in Revenue Online and come back later if you are interrupted. When you come back on the Revenue Online homepage, go to the "Return Actions" menu panel and click "Search for Saved or Filed Return". Enter your email address and the Filing ID from the confirmation screen. Click "Submit".

Select "Submit".

Step 5

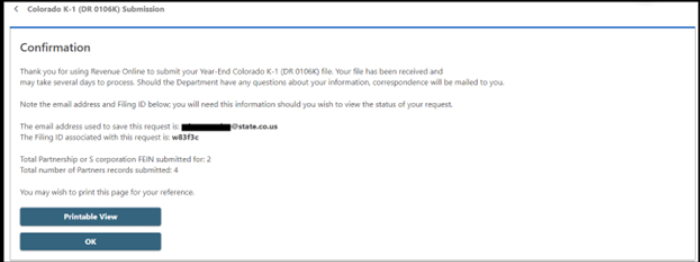

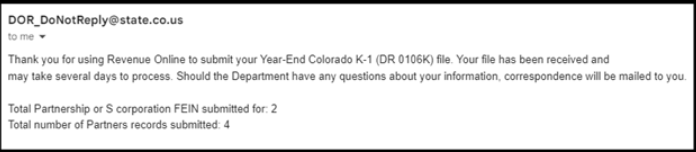

After you submit the data, you will receive a confirmation email and the confirmation screen. Print the confirmation page and keep it in your records.

Paper copies may be submitted with the Annual Transmittal of DR 0106K - Colorado K-1 Forms cover sheet (form 1706) by mail to:

Colorado Department of Revenue

Denver, CO 80261-0006

Paper forms (DR 0106K and DR 1706) can be located at tax.colorado.gov under forms. For tax year 2022, the Department is waiving the signature requirement on form DR 1706. This form will be accepted unsigned if it is timely filed with the Colorado K-1 forms for the Partnership or S Corporation.

Note: Do not submit the copies of the Colorado K-1s issued to partners or shareholders (or the DR 1706 transmittal form) as an attachment to the Partnership's or S Corporation's income tax return (form DR 0106).

Templates

Spreadsheet template (XLS) for Tax Year 2023

Spreadsheet template (XLS) for Tax Year 2022

Sample Files

Spreadsheet Sample (XLS) for Tax Year 2022

Additional Files