Electric Vehicle Tax Benefits

State Tax Benefits

Tax credits

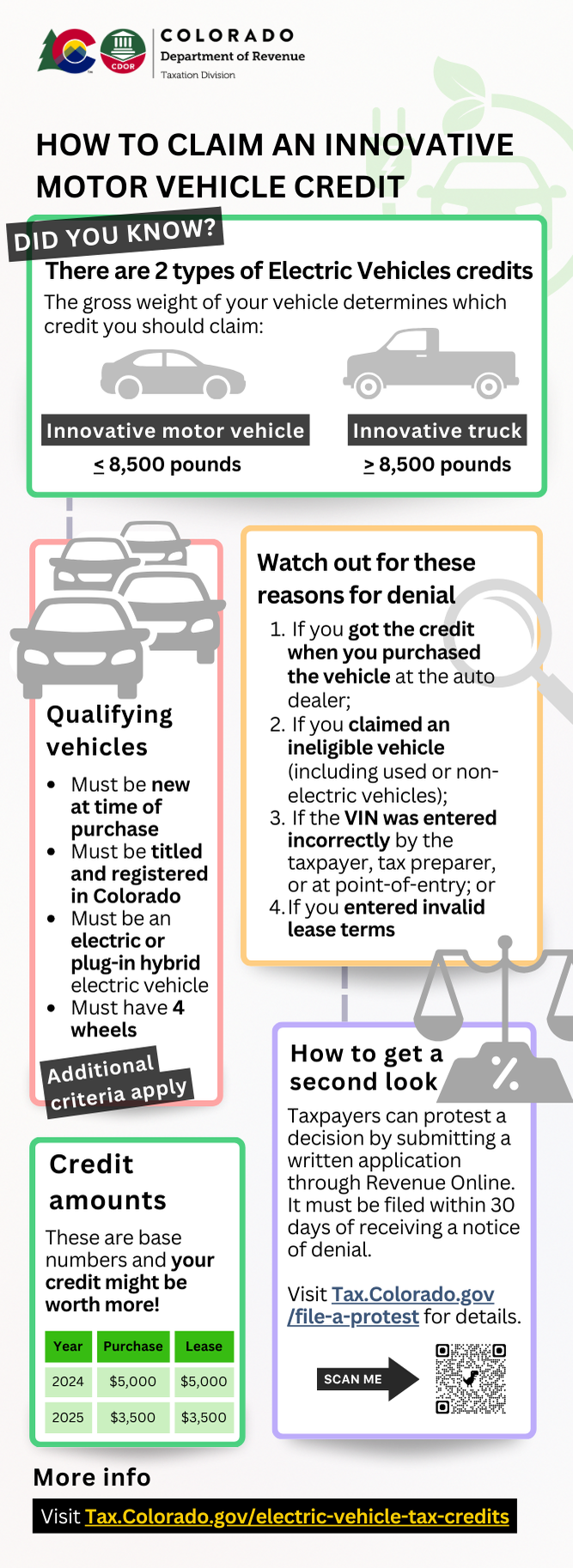

Tax credits are available in Colorado for the purchase or lease of new electric vehicles and plug-in hybrid electric vehicles.

For additional information, please see Department publications Income Tax Topics: Innovative Motor Vehicle Credit and Income Tax Topics: Innovative Truck Credit in the income tax guidance library.

Questions about the Colorado Electric Vehicle Tax Credit? Contact us at 303-238-7378.

Form DR 0617 - Innovative Motor Vehicle Credit & Innovative Truck Credit

Vehicle Exchange Colorado (VXC) Program

Colorado's vehicle exchange program makes the upgrade to an EV more affordable.

The Vehicle Exchange Colorado (VXC) program helps income-qualified Coloradans recycle and replace their old or high-emitting vehicles with electric vehicles (EVs). The VXC rebate will partially cover the upfront cost of the EV at the time of purchase or lease from an authorized automobile dealer.

Federal credit

If you place in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) on or after January 1, 2023 but prior to October 1, 2025, you may qualify for a federal clean vehicle tax credit. Federal and State (Colorado) Tax Credits are separate.

Find more information on federal credits for: used clean vehicles, qualified commercial clean vehicles, and new plug-in- EVs purchased before 2023.