Set Up an Individual Revenue Online Account

Before You Sign Up

Check Your Access Eligibility

Individual, fiduciary, partnership, and corporate income tax accounts are created when the first return is filed with the Colorado Department of Revenue. Then the account may be accessed and managed using Revenue Online. Step-by-step instructions on how to sign up to use Revenue Online are below.

During the Revenue Online sign up process, you will need to have one of these pieces of information to confirm your identity:

- Your most recent filed tax return

- Federal taxable income amount

- Refund amount

- Letter ID

If you have received a recent letter from the Department, you may use the Letter ID number located in the upper right corner of Department tax letters.

Request a Letter ID

If you do not have a recent letter from the Department, you may request a Letter ID number from using Revenue Online. To request a Letter ID, select “Request a Letter ID” from the "Additional Services" box on the Revenue Online homepage. A letter containing your "Letter ID" number will be sent by postal mail to the address on record with the Department. Please note that it could take up to 10 business days to receive this letter.

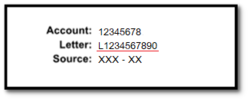

The Letter ID number begins with "L" and an example is below. Please note that the Letter ID is underlined here but will not be on your letter.

How to Set Up an Individual Revenue Online Account

Step by Step Instructions

IMPORTANT INFORMATION:

- A Letter ID acts as a security key to verify your identity and may be used to set up access to your account in Revenue Online, check the status of your refund, or file a protest.

- An account must already exist in the Department of Revenue’s system before a Letter ID can be generated. For Income Tax accounts, this is automatically established when the Department receives and processes your first Colorado Income tax return. For businesses, this is typically achieved by applying for a tax license.

- Your Letter ID will be mailed to the address that is currently associated with your account and it could take up to 10 business days to receive this letter. If you are unsure of the address we have for you, please contact the Department at 303-238-7378.

HELPFUL HINT:

- A Letter ID is generally associated with a particular tax type. You will NOT be able to use a Letter ID from a letter you have received for one tax type to set up access for an account of a different tax type.

- For example, you CANNOT use a Letter ID from a letter regarding your sales tax account to set up access to a wage withholding account.

WHERE TO LOCATE YOUR LETTER ID:

- Once you receive your letter from the Department, the Letter ID number is located in the upper right corner of the letter. It begins with the letter “L” and is followed by 10-digits.

STEP BY STEP INSTRUCTIONS:

- Go to: Colorado.gov/ RevenueOnline

- From the “Additional Services” menu panel, select “Request a Letter ID”

- Review the information on the next screen and select “Next”

- Select ID type from the dropdown menu

- (HELPFUL HINT: Businesses should choose either “Colorado Account Number” or “Federal Employer ID Number” Individuals should choose “ITIN” or “Social Security Number”)

- Fill in the required information and select “Submit”

CONFIRMATION SCREEN:

- Contains your confirmation number should you ever need to contact the Department regarding your request for a Letter ID